Earnings Whispers

By TRG Advisors on April 21, 2021

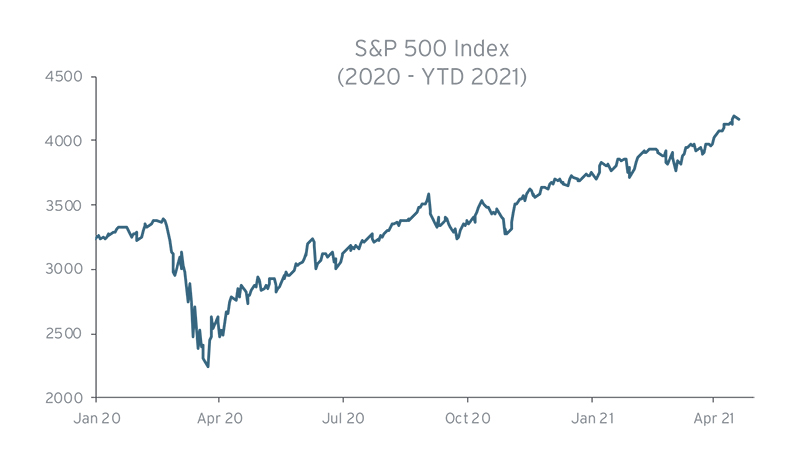

Earnings season is underway, with 80 S&P 500 companies reporting this week alone (16% of the Index).1 Companies reporting this week include American Express, Coca-Cola, International Business Machines, Johnson & Johnson, Lam Research and Procter & Gamble.2 Through Tuesday, April 20, the S&P 500 Index is up 86% from the March 23, 2020 low, and more than 10% year-to-date. Many companies have done better than feared, and that is reflected in stock prices.

Expectations

Going into April, expected year-over-year earnings growth for S&P 500 companies during the first quarter was 24.5%; historically, companies beat estimates by 6.9% on average, implying an even higher growth rate when all earnings are recorded.3 This jump in earnings growth makes backwards-looking valuation metrics challenging, given the rapidly evolving environment. For background, the fourth quarter of 2020 saw 78% of S&P 500 companies beating estimates, with an average beat of 17%.4

The system is awash with liquidity and interest rates remain historically low. Assets in money market accounts and bank deposits remain well above pre-Covid highs.5 Consumers can spend, save, or invest. In prior publications, we have mentioned the historically high savings rate; if consumers spend or invest, those dollars are making their way back into the market.

What We Are Seeing

Beyond earnings’ beats or misses, the nature of company outlooks provides important clues as to what potentially lies ahead. We are looking for consistent messages from companies to reaffirm macro views of the market and the economy.

For travel demand, American Airlines noted “[the company] expects to fly more than 90% of its domestic seat capacity compared to summer 2019 and 80% of its international seat capacity compared to 2019.”6 Pointing to freight costs, Procter & Gamble noted “more than $200 million after-tax from higher freight costs” and “will make pricing adjustments on products where necessary.”7 Coca-Cola noted “March volume was back to 2019 levels”.8

We thought it was interesting to see cash levels for S&P 500 companies remain near $2 trillion, up close to 50% from pre-Covid levels.9 Watch for buyback increases, debt reduction, or business investments (i.e., acquisition activity, research & development) as confidence grows in the economic recovery. Activity in M&A picked up on Tuesday, with Canadian National Railway offering $30 billion for Kansas City Southern (KSU), a bid 20% higher than the offer KSU previously agreed to with Canadian Pacific Railway just a few weeks ago.10 Bigger picture, first quarter M&A deal values in the U.S. totaled $735 billion, up 3.5x year-over-year.11

1 Source: Bloomberg.

2 Source: Bloomberg.

3 Source: FactSet, “S&P 500 Likely to Report Highest Earnings Growth in More Than 10 Years”, April 9, 2021.

4 Source: Bloomberg, Earnings Analysis.

5 Source: Strategas Research, “Daily Macro Brief”, April 20, 2021.

6 Source: American Airlines, “American Airlines Offers More Ways to Reconnect This Summer”, April 14, 2021.

7 Source: Procter & Gamble, “P&G Announces Fiscal Year 2021 Third Quarter Results”, April 20, 2021.

8 Source: The Coca Cola Company, Q1 2021 Quarterly Results, News Release, April 19, 2021.

9 Source: Strategas Research, “Daily Macro Brief”, April 20, 2021.

10 Source: The Wall Street Journal, “Canadian National Makes $30 Billion Topping Bid for Kansas City Southern”, April, 20, 2021.

11 Source: Paul Weiss, “M&A at a Glance”, April 15, 2021.