Peak Inflation? We Don’t Think So

By TRG Advisors on April 18, 2022

Last week, many media outlets were speculating that inflation had peaked. When we saw the data we came to a different conclusion, and we continue to believe that inflation will remain elevated. CPI came in at 8.5%, the highest print since 1981, and PPI came in at 11.2%, the highest print in history. We continue to see rising costs in rents and wages, which are sticky components to CPI (Chart 1). Import-export prices continue to rise; that data is usually a leading indicator for CPI by a month or two.

Chart 1 Rent, Earnings and CPI1

Hot Commodities: Commodities prices also remain elevated. WTI crude oil is still at $106.30 (67% Y/Y), and Natural Gas is at $7.30 (175%Y/Y) (Chart 2). We have hope that commodity prices will come down over time, especially as supply chains get fixed – but at least for now, the data is showing that inflation is here and staying above trend.

Chart 2: WTI Crude vs Natural Gas2

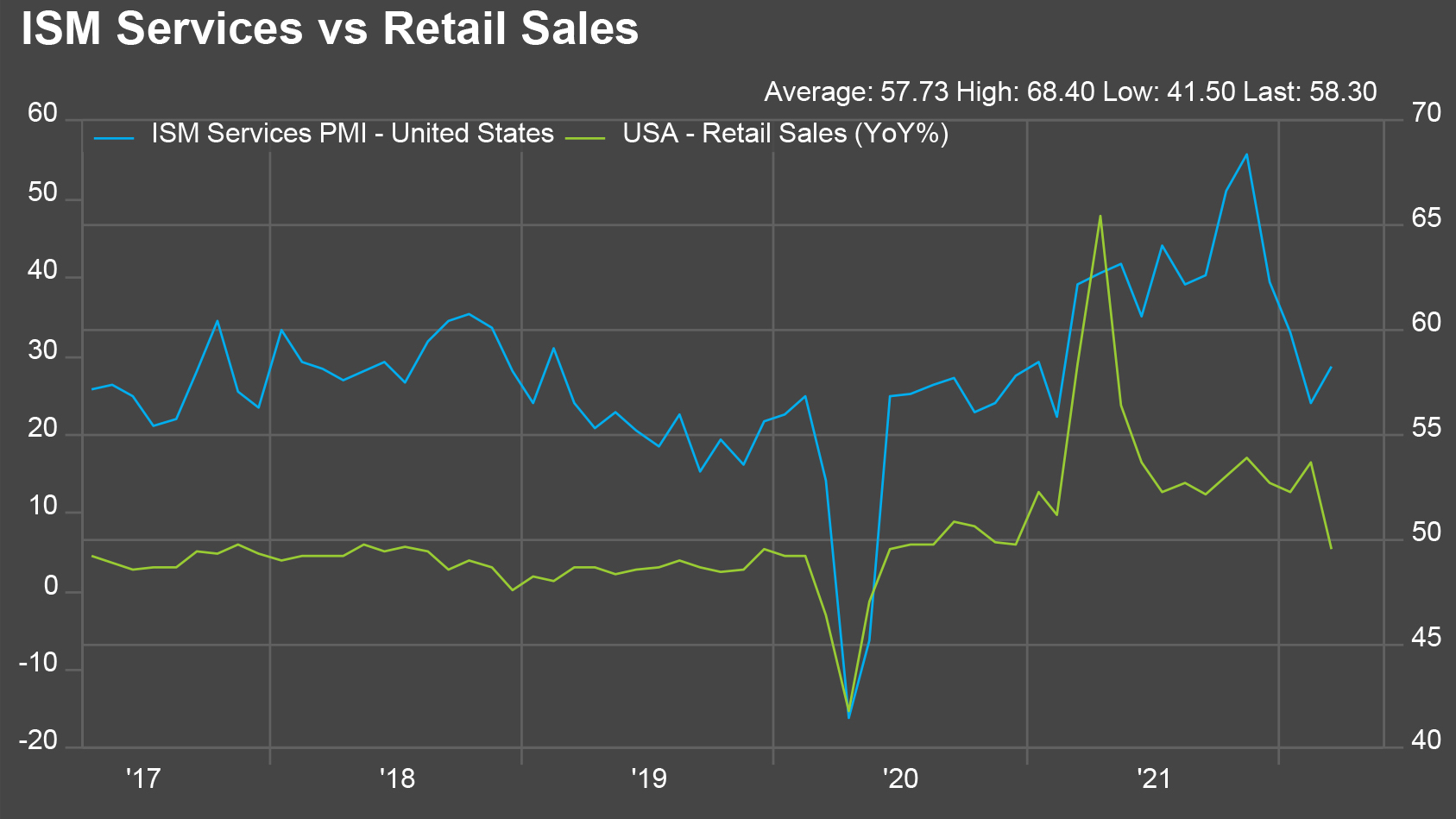

Reopen Ideas Alive and Well: Last week, we mentioned that Carnival Cruise Lines (CCL) reported record bookings. We also saw similar trends from Expedia (EXPE) and Delta Airlines (DAL). Delta is back to 2019 demand levels but with a caveat: Consumer travel is strong, but business travel is just beginning. Most of the banks said that the consumer remains resilient, with JPMorgan (JPM) specifically citing that the consumer is in “extraordinary” shape. We have written that there is a transition within our economy from goods to services, and these items confirm our thoughts. Services is 2/3rds of U.S. consumer spending, and the consumer is 70% of GDP – so this theme is very encouraging and where we have significant exposure in our portfolios. 4. Retail Sales: Retail Sales for March came in at .5% m/m, which was in line with expectations – but, encouragingly, February was revised higher by nearly 3x the initial figure at .8% m/m. Importantly, excluding autos, retail sales rose 1.1% and received another upward revision in February. Non-store, or online, sales fell 6.4% m/m, which followed the February decline of 3.5% m/m. This group was a key beneficiary of “stay at home” for the last two years, and we are now seeing a reversal as consumers begin to “do things” away from home. In fact, food services and drinking places sales increased 1% m/m, which followed a 3% gain in February. And, interestingly, general merchandise stores sales rose 5.4% m/m, which suggests to us people are going out to stores more – another data point on the re-open idea.

Chart 3: ISM Services vs Retail Sales3

Fed Update: Last week, Federal Reserve Governor Lael Brainard remarked on high inflation and stated that “getting inflation down is going to be our most important task” in the coming months. This came shortly after the CPI release showed an 8.5% Y/Y increase, the highest reading in four-decades. It is believed that the Fed will now hike rates in each of the next two meetings by 50 bps each and more thereafter – 8x this year, falling to 4x next. In addition, they will begin to reduce the balance sheet, which has actually steepened the yield curve. Ten-year treasuries rallied throughout the first half of the week only to rise 12 bps on Thursday, ending the week at 2.82%. To put this in perspective, the 10-year yield was at 1.51% on December 31st. Municipal yields rose by 5-7 bps across the curve early in the week and remained at those levels through Thursday’s close. Investment Grade corporate spreads widened by 2 bps, while High Yield spreads tightened by 4 bps.